In 2023, Canada introduced sweeping changes to the trust reporting requirements, significantly impacting how bare trusts file their T3 returns for the tax year ending after December 30, 2023. This guide aims to demystify these changes, helping trustees and beneficiaries navigate the complexities of compliance.

Introduction to Bare Trusts

A bare trust exists when the trustee holds property solely for the beneficiary, with no discretion over its use. Essentially, whenever there is a difference between legal and beneficial ownership, a bare trust has likely arisen.

The trustee’s role is limited to following the beneficiary’s instructions, making bare trusts a preferred vehicle for straightforward asset holding arrangements.

Examples

- Parents coming on as a 1% owner on the title for their young kids to qualify for a mortgage, but do not want any beneficial ownership on the house.

- Elderly parents adding kids to title of the house to avoid probate upon passing, but not relinquishing beneficial ownership of the house until they are alive.

- An individual buying a property under personal name, but then making the corporation a beneficial owner by reporting all income under the corporation.

- For privacy reasons, a property developer establishes a bare trust arrangement that will hold registered title to real property, while the developer retains beneficial ownership.

Note that simply co-signing or guaranteeing a mortgage does not constitute a bare trust. There has to be a legal title on the ownership for a bare trust to exist.

Key Changes to Trust Reporting in 2023

The Canada Revenue Agency (CRA) has mandated that all trusts, barring specific exemptions, file an annual T3 Trust Income Tax and Information Return. This includes detailed beneficial ownership information through Schedule 15, marking a significant shift in reporting obligations.

Affected Trusts

Practically all trusts residing in Canada are affected unless they meet certain criteria, such as holding assets under $50,000 of specific types, being in existence for less than three months, or falling under other specific exceptions outlined by the CRA.

Schedule 15: A Closer Look

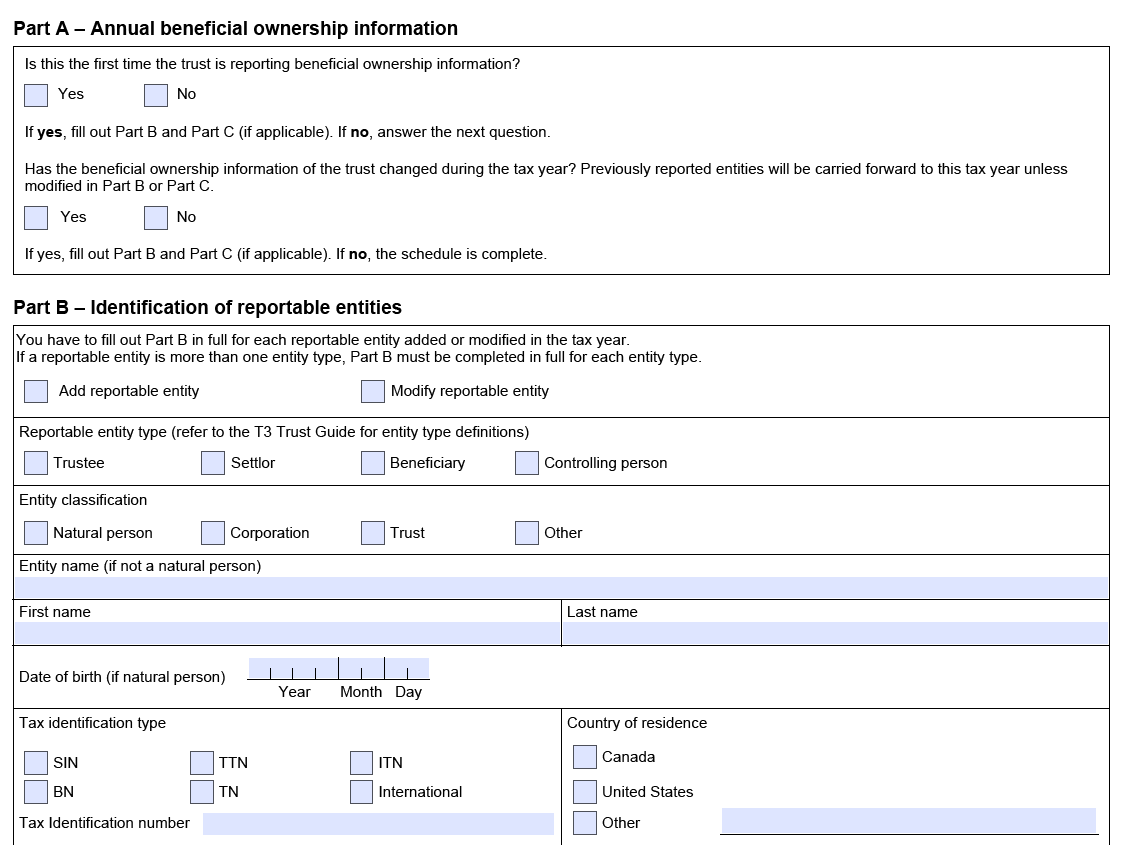

Schedule 15 is now a critical component of the T3 return, requiring information on trustees, settlors, beneficiaries, and any other persons able to exert influence over the trust. This includes their names, addresses, dates of birth (if applicable), residency, and tax identification numbers.

Bare Trusts and the T3 Return

Bare trusts, previously not required to file under certain conditions, are now obliged to submit T3 returns and complete Schedule 15 unless they qualify as a listed trust. This adjustment aims to enhance transparency and compliance within the Canadian tax system.

Filing Deadline for 2023 Returns

For the 2023 tax year, bare trusts must file their T3 return by April 2, 2024 (generally, March 30th but March 30, 2024 falls on a weekend). However, recognizing the adjustment period for these entities, the CRA will provide relief for penalties for late filings under specific conditions.

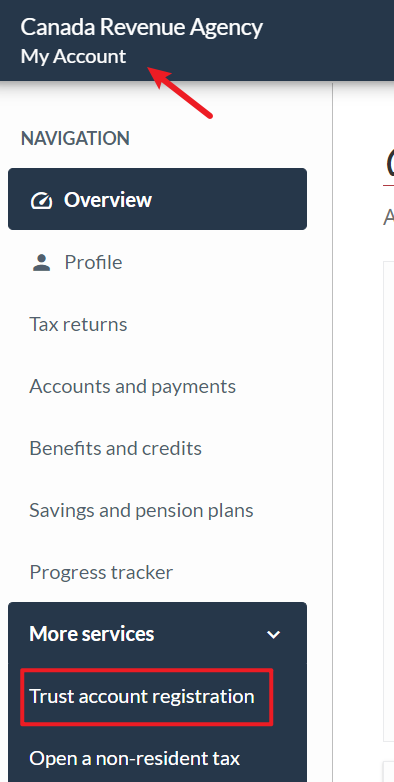

How to Obtain a Trust Account Number

A trust account number is essential for filing T3 returns electronically. Trustees can apply for this number through the CRA’s My Account online portals, ensuring they can meet new electronic filing requirements. See screenshot below.

Our tax team at Think Accounting can also help you obtain a Trust Account Number online as a CRA Representative.

Bare Trust T3 Non-Compliance Penalty

Failure to comply with these new reporting obligations can result in significant penalties, including a fine equal to greater of $2,500 or 5% of trust’s highest fair market value of property during the year. Therefore, understanding and adhering to these new requirements is crucial for all parties involved in bare trusts.

Conclusion

The 2023 changes to trust reporting requirements represent a pivotal shift in how bare trusts are managed and reported in Canada. By staying informed and preparing adequately, trustees can ensure compliance, thus avoiding potential penalties and contributing to the integrity of the Canadian tax system.

If you need help with filing your Bare Trust T3 Return, reach out to our team on this link.