What is Profit First

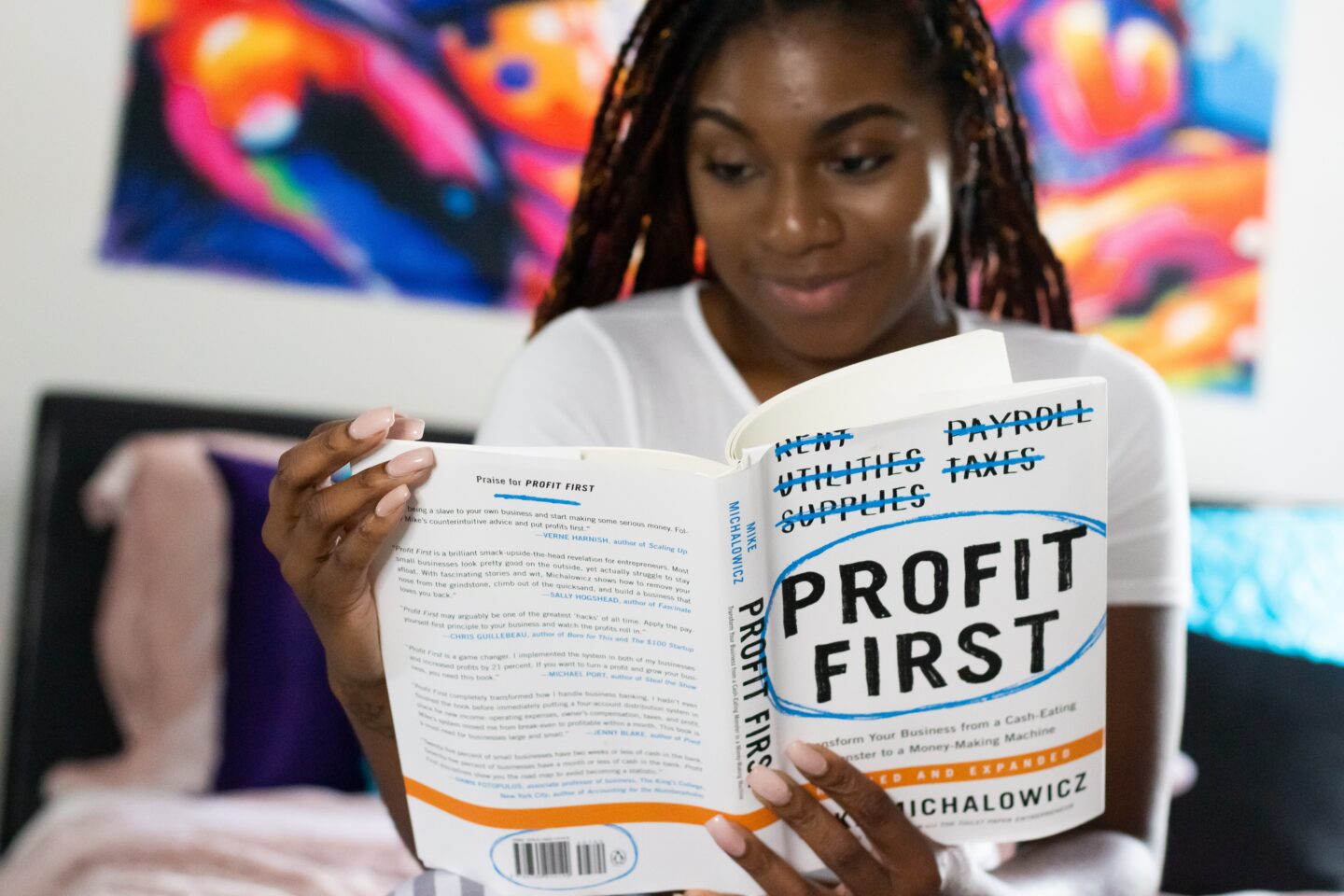

Profit First is a financial management method that was developed by entrepreneur and author Mike Michalowicz. The Profit First method is based on the idea that business owners should prioritize profitability over growth. According to Michalowicz, traditional financial management practices often encourage business owners to focus on growing their revenue and expanding their operations, while profitability is often an afterthought. The Profit First method seeks to change this by putting profitability at the forefront of a business’s financial strategy.

The basic premise of the Profit First method is simple: business owners should allocate a certain percentage of their revenue as profit before paying any other expenses. This percentage is called the “profit first percentage,” and it is determined by the business owner based on their financial goals and the needs of their business. The profit first percentage is typically between 5% and 10% of revenue.

How to Implement Profit First In Your Business

To implement the Profit First method, business owners must first set up separate bank accounts for their business’s various financial needs. These accounts include a profit account, an operating account, a tax account, and a owner’s pay account. Business owners then deposit a certain percentage of their revenue into each of these accounts every time they receive payment from a customer.

For example, let’s say a business owner has determined that their profit first percentage is 10%. If the business receives a payment of $1,000 from a customer, the business owner would deposit $100 (10% of $1,000) into the profit account, $800 (80% of $1,000) into the operating account, and $100 (10% of $1,000) into the tax account.

The profit account is used to pay the business’s profit distribution, which is the amount of money the business owner decides to take as profit. The operating account is used to pay the business’s operating expenses, such as rent, utilities, and salaries. The tax account is used to pay the business’s taxes. And the owner’s pay account is used to pay the business owner’s salary or other compensation.

Benefits of Implementing Profit First Method

One of the key benefits of the Profit First method is that it helps business owners to prioritize profitability and ensure that their business is making enough money to sustain itself. By allocating a percentage of revenue as profit upfront, business owners can ensure that they are taking care of their own financial needs before paying other expenses.

In addition to helping business owners prioritize profitability, the Profit First method also helps to improve cash flow management. By setting up separate accounts for different financial needs, business owners can better track where their money is going and make more informed decisions about their spending.

The Profit First method is not without its critics, however. Some business owners and financial experts argue that the method is too rigid and may not be appropriate for all businesses. For example, businesses that are in a high-growth phase may not have the same profit margins as more established businesses, and may struggle to allocate a high percentage of their revenue as profit.

In Summary

Overall, the Profit First method is a financial management approach that can be effective for businesses that want to prioritize profitability and improve their cash flow management. While it may not be suitable for every business, it can be a useful tool for business owners who want to take a more proactive approach to managing their financial affairs.

Get In Touch

Curious to learn more about Profit First and discuss if implementing it makes sense for your business? Get In Touch with our team at Think Accounting and we’ll be happy to schedule a call!