In 2023, Canada introduced sweeping changes to the trust reporting requirements, significantly impacting how bare trusts file their T3 returns for the tax year ending after December 30, 2023. This guide aims to demystify these changes,...

THINK Insights

Check out the latest articles from our CPA team, focusing on providing the most relevant accounting and tax advice for individuals, families, and businesses.

What Is A Business Meal?

Business Meal Under the Canadian Income Tax Act and CRA's interpretations, a business meal is considered deductible if it meets the following criteria: Purpose: The meal is purchased for a clear business reason, such as meeting with...

Climate Action Inventive Payment 2024 – What You Should Know

What Are Climate Action Incentive Payments (CAIP) aka Canada Carbon Rebate (CCR)? Climate Action Incentive Payments (CAIP), now known as the Canada Carbon Rebate (CCR) are Canada's approach to motivate citizens towards a greener...

How Does A Trust Work In Canada? A Short Playbook

Navigating the world of trusts in Canada can be complex, but understanding their basics, types, and benefits is crucial for effective financial and estate planning. This guide demystifies trusts, focusing on key aspects and common...

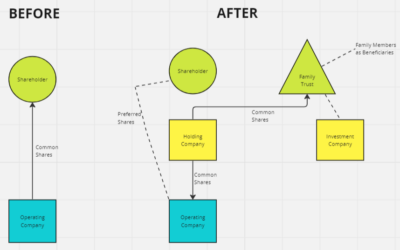

Holding Company Strategy in Canada as a Tax Planning Opportunity

Introduction to Holding Company In the realm of financial strategy and business structuring, the holding company strategy in Canada stands as a beacon of opportunity, particularly in the arena of tax planning. With the right approach, a...

How To Improve Cash Flow In Your Business With These Simple Levers

Introduction: Hi there! today we're discussing how to improve cash flow in your business with some simple levers. We understand that for businesses, particularly small businesses, startups, and e-commerce ventures, maintaining a healthy...

CPP Payments in 2024: What You Need To Know

Introduction Starting January 1, 2024, the Canada Pension Plan (CPP) will undergo substantial changes. These modifications are part of an ongoing enhancement initiative that began in 2019. The key aspect of these CPP payments 2024 changes...

Important Tax Changes in Canada for 2024

Introduction In this blog post, we will detail the important tax changes in Canada for 2024 that you need to know. Last year was difficult with ongoing inflation and rising interest rates, but for the new year, we have good news for...

From Burden to Relief: Unraveling the CRA Taxpayer Relief Process

Introduction To the CRA Taxpayer Relief Process Navigating the realm of CRA penalties and interest is a common hurdle for many Canadian entrepreneurs. Each year, over 30,000 small businesses face penalties due to late filing....

CEBA Loan Extension: Read The Fine Print

In yesterday's announcement, the Canadian government introduced extended deadlines and added flexibilities for the Canada Emergency Business Account (CEBA) loan repayments. The CEBA Loan Extension is a move aimed at providing relief to...

Navigating Tax Implications of Asset vs Share Sale of Your Canadian Business

Tax Implications of a Share Sale An asset vs share sale is a complex tax scenario to address. Let's start with a share sale first. A share sale is essentially a purchase of the entire business. The buyer acquires the shares of the company...

A Primer on eCommerce Accounting for Business Owners [+Actionable Checklist]

Introduction to eCommerce Accounting Practices in Canada Imagine this: It’s a crisp fall day in Toronto, and you, an ambitious entrepreneur, have just launched your first eCommerce store. Maple leaves are falling, and so are the barriers...

What is Contribution Margin? And Why is it Important for your Business?

Learn what contribution margin is and why it is crucial for your business’s profitability. Discover how contribution margin helps you analyze costs, set prices, and make informed decisions. Enhance your understanding of contribution margin’s significance in maximizing profits.

Underused Housing Tax (UHT): Demystified in 10 FAQs

A new underused housing tax (UHT) went into effect in Canada on January 1, 2022. The tax affects property owners with vacant or underused housing and requires them to file an annual UHT return with the Canada Revenue Agency (CRA). In the...

Shareholder Loans Rules: Tax Implications and Compliance with CRA

What are Shareholder Loans? Shareholder loans are funds that a shareholder of a corporation lends to the corporation or borrows from the corporation. For the purposes of this articles, we will focus on the part of money being borrowed by...

Ontario Staycation Tax Credit – How to Get Back 20% of Spending on Your 2022 Personal Tax Return

In recent years, the idea of a "staycation" – taking a vacation close to home – has become increasingly popular. With the COVID-19 pandemic and the resulting travel restrictions and safety concerns, staycations have become even more...

What is Profit First Method and How To Implement It In Your Business

What is Profit First Profit First is a financial management method that was developed by entrepreneur and author Mike Michalowicz. The Profit First method is based on the idea that business owners should prioritize profitability over...

Foreign Tax Credits In Canada – Eligibility, How To Claim, and How Much Can You Claim?

Foreign tax credits in Canada are a way for Canadian taxpayers to reduce the amount of tax they owe on foreign income. To claim foreign tax credits, taxpayers must complete and file Form T2209: Federal Foreign Tax Credits and provide supporting documentation. Only taxes similar to Canadian taxes are eligible for foreign tax credits, and the amount of foreign tax credits that a taxpayer can claim is limited to the amount of Canadian tax payable on the foreign income.

A Primer On Estate Planning

Meet Bob. Bob is a divorced 64-year-old man living in Caledon, Ontario. Bob has five kids who are all over the age of 18. Two of those children are married and he is a recent and proud grandfather to a new little baby girl. Bob retired six months ago and is enjoying spending more time up at the cottage in the Muskokas, as well as taking a little day trips to historic sites around Ontario. He’s a huge history buff! Bob had a Will drafted with his ex-wife over 30 years ago now.

CEWS Extension – Details and Takeaways

Backgrounder: CEWS Extension - Speech from the Throne: Commitment to extend the Canada Emergency Wage Subsidy (CEWS) The government’s Speech from the Throne confirmed its intention to extend the CEWS until June 2021;On October 14, 2020,...

TransferWise for E-Commerce Businesses | Review

Note - The post below is NOT sponsored by TransferWise and this is not a formal recommendation to use TransferWise. At Think Accounting, we work with several e-commerce business owners. In addition, several prospective e-commerce business...

5 Financial Reports To Review With Your Bookkeeper Every Month

Gone are the days when you would take a shoebox of statements and receipts to your accountant once a year. A few months later, your accountant would produce your financial reports and tax return based on the data provided. Perhaps you...

Pricing Lessons For Service Based Businesses

First - Explore the Feelings That Your Work Creates Whether you are Creative Agency owner, an IT consultant, a Lawyer, a Landscaper or some form of a professional who charges for their services based on a service instead of a product,...

UPDATE: Personal Real Estate Corporations (PRECs) Permitted in Ontario

As of October 1, 2020, Personal Real Estate Corporations (PREC) have been permitted in Ontario. This is fantastic news for Ontario Realtors and will allow those in higher tax bracket to defer (and potentially save) on taxes.

USA Sales Taxes And Economic Nexus Rules For Canadian E-Commerce Sellers

You've Started A New E-Commerce Business in Canada And you've started selling into the USA - on www.amazon.com or drop-shipping your Shopify store orders. As if Canadian sales and income tax rules weren't complex enough for you, you now...

Capital Dividend Account: Tax Free Withdrawal Of Funds From Your Corporation

Just like half of the capital gain is tax free for an individual, a capital dividend account is a mechanism by which the shareholders of a corporation are able to withdraw that half of the capital gain that is not taxed.

It’s pretty simple if you think about it.

Why You Should Hire An E-Commerce Accountant For Your Amazon Or Shopify Business

So, you’ve started an e-commerce business or have an existing one but your accountant is still a traditional one.

Check out this post for why you should hire a specialized e-commerce accountant for your business!

GST/HST Quick Method – Simplicity and Savings!

When you use the GST/HST quick method for your business, you still charge the applicable GST and HST on your supplies of taxable goods and services. However, to calculate the amount of GST/HST payable, multiply the revenue from your supplies (including the GST/HST) for the reporting period by the quick method remittance rate, or rates, that apply to your situation.

Medical Expenses Eligible For Deduction On Your 2019 Tax Return

Did you incur any medical expenses in 2019? Perhaps you are getting ready to put everything together for your 2019 personal tax return, and are preparing a list of medical expenses eligible for deduction. Will these medical expenses even...

T4 vs T4A: Differences and When To Issue Which Slip

T4 vs T4A - What's the Confusion? There is a common confusion each year among business owners understanding when to issue a T4 vs T4A. Business owners who employ several individuals may have staff working full-time, part-time,...

![A Primer on eCommerce Accounting for Business Owners [+Actionable Checklist]](https://thinkaccounting.ca/wp-content/uploads/A-Primer-on-ECommerce-Accounting-min-400x250.jpg)