Xero Accounting Specialist

Build Your Business With a Xero Cloud-Based Solution From Think Accounting?

When you’re ready to level up your accounting system, you need the right software combined with the pro team to make it work.

That’s why the tech-savvy experts at Think Accounting specialize in integrating industry-leading Xero Cloud Accounting software into their online cloud accounting solutions. We’ve helped clients across many sectors save time and make more money with the tools and insights they need to make informed business decisions and accurately track their financial position.

App Integrations

Xero + Apps = Time Saved

Why Use a Xero Cloud Accounting Solution?

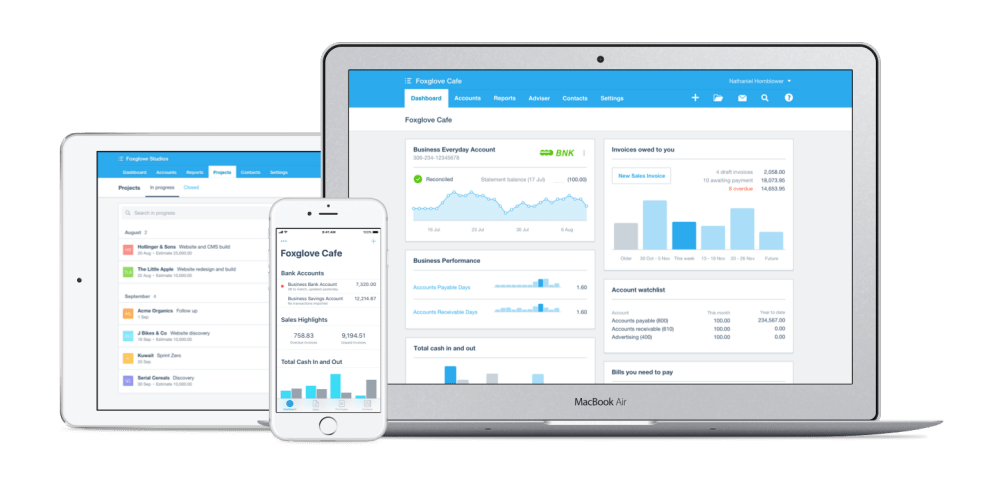

Xero offers all of the essential tools your business needs to succeed and grow, such as custom invoicing, expense tracking, payroll processing, and more, all easily managed from a single, easy-to-use dashboard.

- Easily and securely access real-time information about your financial picture anytime from your computer, laptop, or mobile device

- Seamlessly collaborate with your team, advisors, and other stakeholders with multi-user functionality

- Software updates, system monitoring, and server maintenance are all fully automated

- Understand your cash position with daily updates from your bank accounts and credit card statements

- Watch trends, formulate projections, and prepare for tax time with robust reporting features that help you make informed business decisions

THINK Innovation

Think Accounting’s Xero Cloud Accounting solutions helps businesses streamline their processes and make bigger profits for all industries, including:

THINK Approach

Discovery Call

We schedule a meeting or phone call to learn all about your business, ask pertinent questions, and listen to your needs.

Create a Customized Plan

After making a thorough assessment of your unique needs, we’ll begin developing a customized action plan with pricing clearly outlined.

Onboarding

We set up the systems and workflows, connect your solution to your accounting apps and connect you with a Think Accounting team member.

Kick-Off

With deadlines and deliverables clearly identified on our end so your business is always compliant with CRA. You’ll also receive ongoing proactive strategies from our experts.

Certified Xero Accounting Professionals in Toronto, Calgary, Vancouver and across Canada

Ready to experience how an innovative Xero cloud-based accounting solution can help build your business? Contact the tech-savvy team at Think Accounting today for a no-obligation discussion today!

THINK FAQs

Do you provide customized accounting Services or Solutions based on the nature of business?

Absolutely. Each industry is unique and within each industry, each business is unique. For e.g. E-Commerce Accounting is very different from Creative Agency Accounting. We have separate processes in-house for different industries that we follow to deliver our services. We build our scope of work and deliver on that scope customized to your business, instead of using a cookie-cutter approach.

Do you provide Bookkeeping-only services (that is, if I already have a year-end accountant)?

In rare circumstances, yes. However, majority of the time, we provide a full-service package service that includes Bookkeeping, Financial Statements, Tax Returns, and, if applicable, Payroll.

Do you provide Year-End-only services (that is, if I already have a Bookkeeper)?

Yes, we do. We prefer that you have a professional bookkeeper taking care of your books and bank accounts are reconciled. If you as a business owner do your own bookkeeping, we will first need to review your bookkeeping before giving a fee quote for year-end scope of work.

Do you provide Audited or Reviewed financial statements?

No. We provide Compilation Engagement Financial Statements (previously called NTR or Notice To Reader). For your Audited or Reviewed Financial Statement needs, we are able to connect you with firms in our network.

Which Industries do you work with?

Although we work with most industries, we have specialized knowledge of clients in the E-Commerce, Startups, Medical and Creative Agencies space.

Do you provide Accounts Payable and Accounts Receivable Services?

We provide Accounts Payable services on a monthly frequency basis. We’ll setup a paperless workflow for you to provide all bills to be paid, and set up a payment platform for you. After that, we’ll follow a once-a-month process to schedule bills to be paid for the month.

We do not provide Accounts Receivable (Cash Collection) services.

Do you help with Advanced Tax Planning (Reorganization of Corporate Structure, Estate Planning, etc.)?

Absolutely! It’s one of the ways we add tremendous value to our clients. Our Advanced Tax Planning work is structured as follows:

- Discovery Call – To gather a high-level background and understand your goals and objectives.

- Phase 1 – To assemble all detailed background, tie the tax research to your specific situation, design the solution and steps for your reorganization, and present you with the solution(s).

- Phase 2 – Implementation of Phase 1, which incudes coordination with lawyers and business valuators. We summarize all of the work performed in a detailed Memo for you and your advisors.